Who we are

Abris is the leading ESG transformation specialist private equity firm.

We aim to deliver strong returns to our investors by helping Central Europe’s most ambitious mid-market businesses grow into regional and international champions. We seek to partner with businesses that will benefit from the input of capital and management expertise at both strategic and operational levels.

For us, there is no difference between ‘investing’ and ‘responsible investing’. We believe ESG excellence is key to both effective risk mitigation and value creation, and that companies that lead on ESG will deliver better long-term returns for investors. Abris was certified as a B Corp in May 2023.

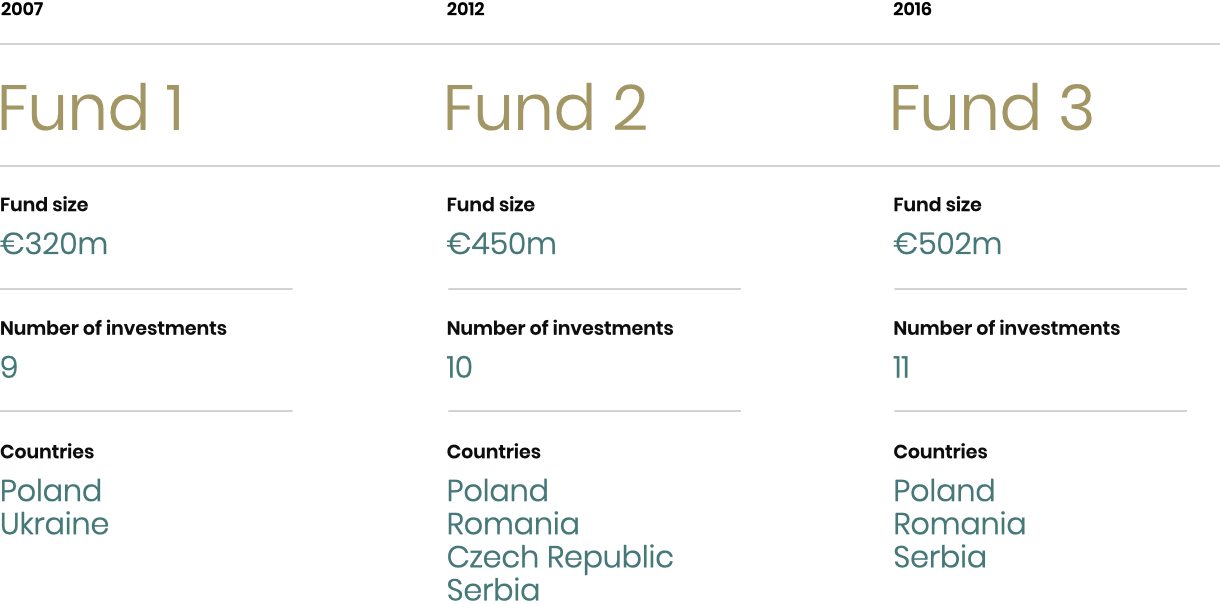

With investment capital of almost €1.3 billion, Abris has obtained financial backing from many leading global investment institutions, including corporate and public pension plans, DFIs, funds of funds and university endowments. Established in 2007, Abris now employs a total of 40 professionals, based in Warsaw, Bucharest and Cyprus.